Looking to learn more about the habits of experienced investors? Having collectively worked in the financial markets for over 40 years, our IFAs have built up a wealth of invaluable experience and insight into the complex world of investing.

Individuals invest for a variety of reasons.

Firstly, some invest to build and accumulate wealth. Secondly, investors look to use this wealth as income in later life. Certain individuals who have already accumulated wealth can use their investments as an immediate source of income.

Furthermore, leaving a financial legacy for their loved ones is another reason people invest.

Investing carries no guarantees. Markets fluctuate, and investors can make losses. On the other hand, investors can realise huge returns over time.

In this article, we are sharing 6 key attributes and habits of experienced investors.

What are the 6 key attributes & habits of experienced investors?

There are many habits experienced investors possess including:

1: They started their investment journey early & invest regularly

2: Experienced investors don’t panic when during recessions and market volatility

3: They understand the importance of diversifying their investment portfolio

4: Experienced investors often seek the advice of an independent financial adviser

5: They maintain good financial habits

6: An understanding investing is about time in the market, not ‘timing’ the market

Let’s take a look at each.

1: They started the investment journey early & invest regularly

Experienced investors have the discipline to invest consistently and regularly. They started their journey early and took a long-term view. Investing is for the long term. It isn’t a means to get rich quickly.

If you start your investment journey when you are 60, lifetime expectancy denotes you have less time to realise returns than if you started when you were 25.

Furthermore, the same is true for pensions. if you start investing in your 20s, you are likely to achieve a much bigger pension pot than if you started later. Aside from planning for retirement, there are many reasons people should consider investing in a pension.

2: Experienced investors don’t panic when recessions happen

Market corrections, share price fluctuations, and recessions are a part of the investment journey. Nobody knows exactly when the next recession will be.

Even the most seasoned, experienced investor doesn’t know when a certain company may see its share price dive. And, nobody knows when a recession will end, or exactly when markets will rebound.

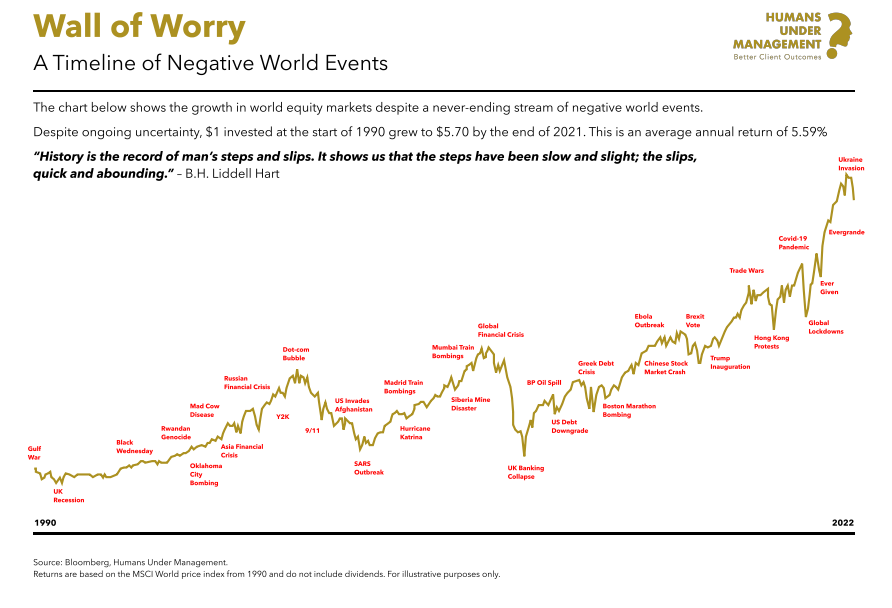

The graph below highlights the historical moments when recessions occurred and when there was a significant market downturn.

It also shows how markets have rebounded over time, highlighting how investing is for the long term.

3: They understand the importance of diversifying their investment portfolio

Experienced investors know why it’s important to diversify. Before we get into the reasons why diversification is important, for those new to investing, here is a quick definition.

Diversification is a technique that reduces risk by allocating investments across various financial instruments, industries, and other categories. It aims to maximize returns by investing in different areas that would each react differently to the same event.

Source: The Importance of Diversification – Investopedia

Simply put, if you diversify your investments, you are reducing your overall risk and increasing the potential for returns, by spreading your risk.

If all your investments are in shares, you are completely exposed should share prices fall. The same can be said for property if the housing market tumbles and all of your investments are in buy-to-let investments.

A well-balanced investment portfolio covering shares, bonds, property, pensions, and more can help to produce the long-term returns investors are looking for.

4: Experienced investors will have sought the advice of an IFA

Independent financial advisers offer a wealth of experience to those looking to invest. An IFA will take the time to listen to your objectives and can make informed recommendations.

They will also work with you to form a plan, aligned with your current levels of available capital and what you can afford to sensibly invest over time.

It is likely they have experienced recessions and have helped many individuals throughout times of economic uncertainty. An IFA offers a steady hand and helps individuals avoid short-term, knee-jerk emotional financial decisions.

Surely any financial adviser can help? Why work with an independent financial adviser?

Independent financial advisers can offer whole-of-market advice. This means they can select, and recommend the most appropriate investments from all of the available options in the market.

If a financial adviser isn’t independent, they are likely tied to a small pool of investments, and the advice they can offer is restricted.

Which do you think is better for you?

Working with an adviser who has access to all of the investments in the market, or one that can only ‘sell’ you a ‘product’ from a restricted pool of investments.

These are just some of the reasons to work with an independent financial adviser.

5: They maintain good financial habits

Adopting good financial habits will help you stay on top of your finances, save money, and spend wisely.

Here are some tips for maintaining good financial habits:

- Review your general expenditure and spots areas where you can save money

- Analyse your energy bills and ask yourself if you could get a better deal elsewhere

- Formulate a personal financial plan and stick to it

- Set financial goals, and measure if you are achieving them

How does adopting and maintaining good financial habits help with investing?

If you can find ways to save money, you will have more to invest into your or your family’s future.

Furthermore, if you create a plan and a budget, you will likely be more financially disciplined and invest regularly.

Watch our video on good vs bad financial habits.

6: Time in the market, not ‘timing’ the market

As mentioned earlier in this article, no one knows when the next recession will be.

Even the most experienced investor doesn’t know when the market may correct. And, more importantly, when it will rebound. What we know from history, is that recessions do happen and that over time, markets have rebounded.

Inexperienced investors often try to ‘time the market’.

What does this mean?

Some investors try to find the perfect time to enter the market. Some look to exit the market when they think prices will start sliding or continue to fall.

When shares are falling, some investors will try to work out when prices are likely to rebound and will make a call on when they think they should re-enter the market.

This is often fuelled by emotion, and fear.

If a seasoned investor can’t predict exactly when a recession will happen or markets correct, inexperienced investors should certainly avoid making emotional, ill-informed short-term decisions.

Experienced investors know ‘time in the market‘ is the recommended mindset

Investing is for the long term. It is the reason why seeking the steady hand of an investment specialist, or independent financial adviser can pay dividends (no pun intended).

The graph in an earlier section of this article shows long-term investing is likely to offer the best chance of a return.

You may strike lucky over a 5-year period, but investing over 25 years and more will help give you the best chance of returns.

Ride out the recessions.

Avoid making short-term knee-jerk decisions.

Of course, there are induvial reasons you may look to cash in investments, so we are not saying to leave your money invested, no matter what.

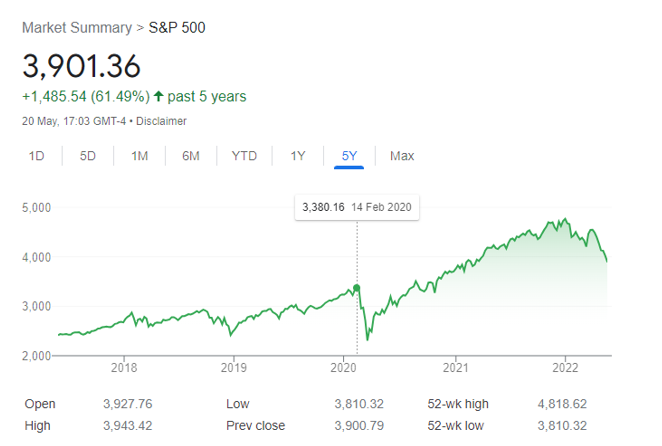

Here is a graph highlighting the initial impact the looming threat of a pandemic had on the markets. You will also see how the markets responded over time.

Source: Google

Related video: Don’t Panic! – How To Cope With Market Volatility

About Sterling & Law – Hampshire

With offices in Fareham and Lee-on-the-Solent, we offer affordable financial advice to a range of individuals and families.

With a dedicated investment advice service, we are on hand to help – no matter where you are in your journey.

Call us today on 01329 550190 for a free no-obligation conversation about your financial needs and investment objectives.

Note: This article doesn’t constitute financial advice. Your capital is at risk when investing in equity markets. Past performance is not a guide to future returns. Investments can go down as well as up and you could get back less than you originally invested.